|

| ||||||||||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||||||||||

|

Monday, September 20, 2010

MMG Weekly: Bonds say to China...Yuan-na Piece of Me?

MMG Weekly: Bonds say to China...Yuan-na Piece of Me?

| If you can't see the newsletter, or would like to view it online, use this link | If you have received this newsletter indirectly and would like to be added to our weekly distribution list, use this link |

|

|

| |||||||||||||

| ||||||||||||||

| For the week of Sep 20, 2010 --- Vol. 8, Issue 38 |

| In This Issue |

|

|

| Last Week in Review: Bonds may sink or swim on the value of the Chinese Yuan. Here’s why. Forecast for the Week: Why are the markets watching the Autumnal Equinox? View: How to handle fundraisers and donation requests as the new school year starts. |

| Last Week in Review |

|

|

| "NOT ONLY CAN WATER FLOAT A BOAT - IT CAN SINK IT ALSO." Wise words, but you don’t need to know that Chinese proverb to know that a knife can cut both ways. The same is true with the strong ties between the Chinese and US economies. For example, news came out last week that Chinese factories stepped up production in August, which helped ease concerns of a double-dip recession in US and, as a result, helped move Stocks higher earlier in the week. But additional news regarding China is also impacting the Bond market - and could impact home loan rates in the future, depending on how the events unfold. Here’s what’s happening. There have been numerous accusations that China has kept their currency artificially low, in an effort to fuel their exports. Some American businesses remark that this is an unfair competitive advantage, and call for tariffs to be levied against Chinese goods. It would appear that a stronger Chinese Yuan would help to resolve this problem... but remember there can be some nasty unintended consequences, due to the relationship between Chinese currency and our Bond prices. The way that the Chinese keep their currency weak against the Dollar is by buying massive amounts of our Bonds, including Mortgage Backed Securities. And their heavy buying has helped keep home loan rates low. So strengthening the Yuan would require fewer purchases of our Bonds and Mortgage Backed Securities - and that would be negative for home loan rates. To paraphrase the Chinese proverb above, the value of the Chinese Yuan may help determine whether Bonds sink or swim in the near future. That makes this a complicated situation... but you can count on me to continue to monitor it closely.

The Chinese Yuan May Help Bonds Sink or Swim

Bonds saw a nice rally earlier last week, due to speculation about the Fed making additional purchases of Bonds in the future. Last week, Goldman Sachs said the Fed may announce another $1 Trillion asset purchase at the November meeting. And while this is just speculation, many Bond traders bid prices higher on the chatter. Adding fuel to this story was an article in the Wall Street Journal, suggesting the same thing. On the other side of the debate, however, is Richmond Fed President Jeffrey Lacker, who stated that the US is far from needing more Bond purchasing by the Fed. In other economic news, the Labor Department reported the inflation measuring Consumer Price Index (CPI) for August at 0.3%. That reading was just slightly above the 0.2% that was expected, but it was still a relatively tame reading. When stripping out volatile food and fuel, Core CPI was flat at 0.0%. This rather benign read on inflation allowed traders to breathe a sigh of relief and push Bonds higher. Prior to receiving the news, many traders were worried the CPI reading would be higher than expected. That’s because the Producer Price Index (PPI) was reported the day before and showed wholesale inflation rose by 0.4% in August. That was above the 0.3% expected and the biggest gain in 5 months! Remember, inflation is the archenemy of Bonds and home loan rates, so any indication that inflation is increasing could cause home loan rates to worsen. IT’S THAT TIME OF YEAR AGAIN! THE START OF THE NEW SCHOOL YEAR MEANS THE BEGINNING OF SCHOOL FUNDRAISERS AND DONATION REQUESTS. ALTHOUGH THE INTENTIONS ARE GOOD, THEY CAN BE TOUGH ON YOUR BUDGET. FOR TIPS ON HOW TO HANDLE ALL THOSE REQUESTS, CHECK OUT THE MORTGAGE MARKET GUIDE VIEW BELOW. |

| Forecast for the Week |

|

|

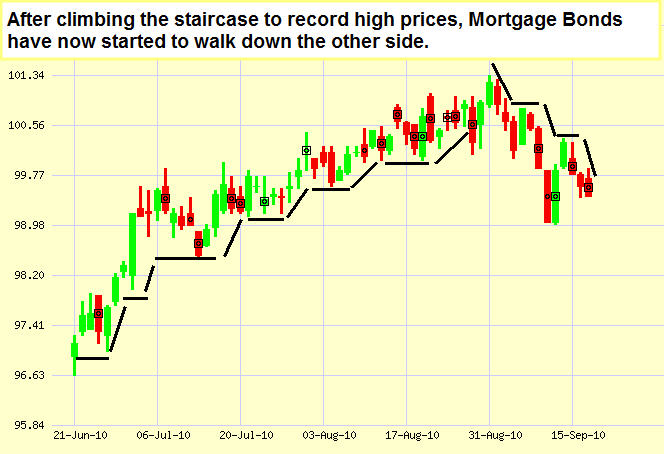

| The Fed will hold their Federal Open Market Committee (FOMC) meeting next Tuesday - and always, the markets will be listening closely when the Fed’s Monetary Policy and Rate Decision are announced. Also on tap for next week are new reports on the health of the housing industry, beginning with Housing Starts and Building Permits for August on Tuesday. We’ll also see reports on Existing Home Sales on Thursday and New Home Sales on Friday. Thursday brings another round of Initial Jobless Claims. Last week, the Labor Department reported Initial Jobless Claims fell to 450,000, below estimates of 460,000 and the lowest reading in two months. While 450,000 claims are still a pretty high number, it is improved from recent readings. Finally, we’ll get a look at manufacturing on Friday with a new report on Durable Goods Orders for August. Durable Goods Orders are considered a leading indicator of manufacturing activity, and the market often moves on this report despite the volatility and large revisions that make it a less than perfect indicator. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see from the chart below, Mortgage Bonds have started to step down after climbing to a record high at the end of August. Overall, Bonds and home loan rates ended the week worse than where they began. The good news is home loan rates are still at historically great levels for homebuyers or homeowners looking to refinance... but that situation won’t last forever.

Chart: Fannie Mae 3.5% Mortgage Bond (Friday, September 17, 2010)

|

| The Mortgage Market Guide View... |

|

|

| When Your Child's School Asks You to Give, Give, Give Here's how to handle all those requests for classroom supplies, fundraiser contributions and more. By Cameron Huddleston, Kiplinger.com Parents, I know you're feeling the pull on your purse strings from you children's schools. You're being asked to contribute supplies to your children's classrooms (not just pencils and paper, but even cleaning supplies). You're expected to donate money to help with the schools' fundraisers. You're getting notes from teachers each week about this field trip or that art project you have to pay for if your children want to participate. I know because I'm a parent with one child in a public school and one child in a private preschool. As president of the parent committee at one of my children's schools and vice-president of the parent-teacher organization at the other, I also know how much the schools need financial support from parents. So how do you balance your desire to help with the reality of your own limited funds -- and avoid looking like a cheapskate if you can't open your wallet every time the school asks? Even though this is your child and his school we're talking about, you have to approach this like you would any other financial situation. You have to... Set a budget. If this is your child's first year in school, talk to his or teacher, parents with older children or members of the parent organization to get an idea of how much you'll be expected to spend on supplies, field trips, etc. or to contribute to fundraisers throughout the year. If your child is a returning student, you already have a pretty good idea. Once you have a dollar amount, it will be easier to figure out whether you can make room in your budget to help out your child's school. Our budget worksheet can help. Prioritize. Of course the school, its parent committee and your child's teacher would love for you to donate every time they ask, but they also understand that not every parent can. So contribute only when it fits in your budget and when you feel like your contribution will have the most impact. That might mean skipping the chili-supper raffle in order to buy a coffee mug adorned with your child's art so his or her feelings don't get hurt. Give your time. You might not be able to afford monetary contributions, but you can donate your time. Schools need volunteers to help in the classroom, cafeteria, you name it. Reprinted with permission. All Contents ©2010 The Kiplinger Washington Editors. www.kiplinger.com.

Economic Calendar for the Week of September 20-24, 2010 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of September 20 - September 24

|

Tuesday, September 7, 2010

Special Holiday Article

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||

|