| For the week of Nov 22, 2010 --- Vol. 8, Issue 47 |

| In This Issue |

|

|

| Last Week in Review: The debate over Quantitative Easing continued, as did the volatility in the markets. And Bonds and home loan rates sure felt the pinch! Forecast for the Week: It will be a busy week ahead of the Thanksgiving holiday, with more Treasury auctions and a very full calendar of economic reports. View: The holiday shopping season is gearing up, but you don't have to be afraid of the crowds, thanks to these easy and inexpensive gift ideas. |

| Last Week in Review |

|

|

| "ACTIONS SPEAK LOUDER THAN WORDS." And this week, we saw a whole lot of loud action in the volatile financial markets...and also heard a lot of words, as the debate over the Fed's latest round of Quantitative Easing continued. Here's what you need to know about what was said...and what happened to home loan rates. If you've been wondering what Quantitative Easing (QE) actually is, it's the concept of the Fed becoming a buyer of Treasuries and Bonds to try and stimulate the economy. The Fed's goal for this latest round of Quantitative Easing (dubbed QE2) is threefold:

And while the Fed won't come out and say it outright – as they don't want to be accused of currency manipulation – one of the consequences of QE2 is that the US Dollar will weaken. And this helps make US exports more affordable abroad, as well as make imports appear relatively more expensive. In fact, as the image shows, the Dollar has weakened versus the Euro quite significantly since QE2 began. But this will help large multi-national companies, which have a large influence on the economy and the major Stock market indices. And stimulating our economy towards continued growth is the Fed’s main goal for QE2. Yet the debate rages on...even now that QE2 has begun...with respected opinions on both sides as to the wisdom of the Fed's policy. German Finance Minister Wolfgang Schauble went so far as to call current US economic policy "clueless." But supporting the Fed's position were last week's tame inflation readings at both the wholesale and consumer levels, via the Producer Price Index and Consumer Price Index Reports. However, with news last week that Ireland’s banking system is in a dire situation, like Greece's earlier this year, opponents of QE2 point to those countries when they speak to the danger of taking on debt, like the Fed is doing again via QE2. One of the most important things to understand is this: the three goals of QE2, while meant to improve our economy overall and for the long-term, are unfriendly to Bonds and home loan rates. And that was evident last week, as Bond prices and home loan rates ended the week worse than where they began. In fact, last week legendary investor Warren Buffet said, "I think short-term and long-term Bonds are a very poor investment at the present time." If Mr. Buffet thinks long-term Bonds are a poor investment right now, he is saying home loan rates can't come down much further - and the risk in waiting around for that to potentially happen does not outweigh the potential reward. Give me a call if you want to review your situation, or forward this email to a friend, family member or colleague who might benefit. I'm always happy to talk to your referrals, and provide a complimentary consultation. BLACK FRIDAY IS JUST A FEW DAYS AWAY! JUST AFTER THE FORECAST, YOU WON'T WANT TO MISS THE MORTGAGE MARKET GUIDE VIEW ARTICLE, ON FIVE INEXPENSIVE GIFT IDEAS THAT CAN MAKE YOUR HOLIDAY SHOPPING EASY. |

| Forecast for the Week |

|

|

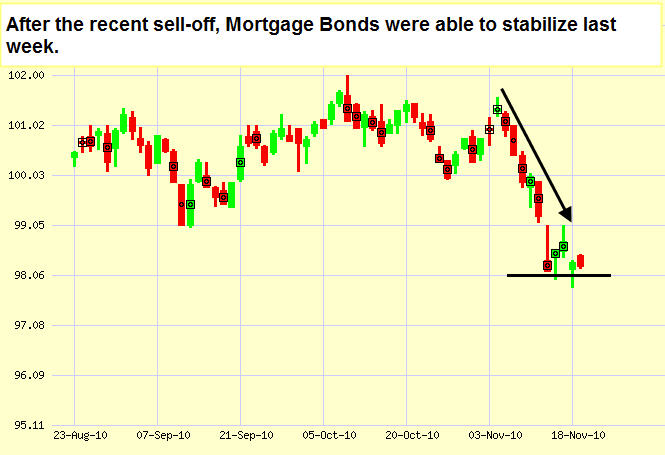

| On Wednesday, we'll have a virtual feast of economic reports just ahead of Thanksgiving. We'll get another round of housing news with the New Home Sales Report, plus another read on the economy with the Durable Goods Report, which gives us an update on consumer and business buying behavior on big-ticket items that are designed to last for an extended period of time. Not to be left out, there will be jobs news via the Initial and Continuing Jobless Claims numbers, and inflation news via the Personal Consumption Expenditures (PCE) Index, which happens to be the Fed's favorite gauge of inflation. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, it's been a volatile few weeks for Bonds and home loan rates as they've been attempting to stabilize. With so many economic reports on tap this week, the volatility will likely continue. If you have any questions about your situation, call or email me anytime! By the way, the financial markets will be closed all day on Thursday in honor of the Thanksgiving holiday, while on Friday the Stock and Bond markets will close early, at 1:00 p.m. ET and 2:00 p.m. ET respectively. I wish you and your loved ones a safe, happy, and fun Thanksgiving! Chart: Fannie Mae 3.5% Mortgage Bond (Friday, November 19, 2010)

|

| The Mortgage Market Guide View... |

|

|

| 5 Inexpensive, Easy-to-Purchase Gifts Black Friday's almost here. And, after that there's the busy holiday season. But just because it's the holidays, doesn't mean shopping has to be hectic or expensive. The following list offers 5 easy-to-get, inexpensive gift ideas. 1. Gift Cards – Anyone who says a gift card is impersonal has never received one. It doesn't get any more personal than allowing someone the opportunity to pick out the gift they really want. The fact is, gift cards are often well received…and nowadays they’re easy to purchase just about anywhere so you probably won’t even need to stand in a long line. 2. Godiva Chocolate – For any diehard chocolate lover, Godiva offers several gift selections for under $25. It's not only a delicious product, but receiving chocolate in a little gold box is about as iconic as receiving jewelry in a little blue box. Visit www.Godiva.com to see the various selections. 3. Lottery Tickets – Buying $20 worth of scratchers as a holiday gift is easy to do and can make an exciting holiday gift, especially if some of them hit. Besides, the idea of scratching off 20 lottery tickets does sound like fun. Tuck them inside a thoughtfully-written card and you're all set. 4. Movie Tickets for Two – If you know a couple of movie fanatics, this is an ideal gift. After all, free tickets are like gold to them. You could even combine this gift with idea #1 above by purchasing a gift card to a restaurant so the movie lover can make a “dinner and a movie” night out of it. 5. Homemade Gift Basket – Putting together a gift basket for someone allows you to tailor the gift precisely to the interests of the person who's receiving it. Gift basket themes are limitless and can fit into any budget. Good luck and happy holiday shopping!

Economic Calendar for the Week of November 22-26, 2010 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of November 22 - November 26

|