|

| In This Issue... |

|

|

| Last Week in Review: Volatility was extremely high... but the bottom line is a tremendous opportunity. Read the details below! Forecast for the Week: Go beyond economic reports! Find out what to watch and why. View: Know a college student who graduated or will soon? Here are 10 great gift ideas you may never have considered! |

| Last Week in Review |

|

|

| "SLOW DOWN... YOU MOVE TOO FAST." Maybe the economic recovery is taking acue from these 1960's lyrics by Simon and Garfunkel, as the economic recovery seems to be in a sluggish state at the moment. And while it doesn't leave too many Americans "feelin' groovy," there are some amazing opportunities at hand in housing. Here's what you need to know about the economy and housing industry - along with one sure thing about the current situation. Although the Hourly Earnings component of the report came in a little better than expected, the overall report was just plain bad. Even for a market hungry for good news, there was no way to spin this report. Now the markets will have to wait and see if this was a one-off bad report and just a bump in the road to recovery... or if things have indeed slowed down once again. Manufacturing slowing? New data on the manufacturing sector of the economy also indicated a possible slowdown, as the Chicago PMI and the ISM Index - which both measure manufacturing - came in below expectations. Rumors of a bailout lower the US Dollar. In news across the pond, reports came out last week that Germany is putting together a plan to bailout Greece. The plan would "kick the can down the road" a little longer for Greece, allowing them more time to figure out a strategy to get their debt in order. As a result of these bailout hopes, the Euro was strengthened and the US Dollar dipped lower. Remember, a softer US Dollar helps US Stocks, as US companies benefit from stronger exports with a weakening Dollar. But a lower Dollar isn't so good for Bonds, so this news stalled the rise of Bonds early last week. Home prices still very affordable. Moving from Europe back home to the US, we also received new data last week on home prices across the country. According to the 20-city Case-Shiller Home Price Index, prices were down 0.8% in March. Overall, foreclosures and bank-owned sales continue to weigh on housing - and are expected to do so for a couple more quarters. That said, the housing market is very localized, so only a local real estate professional can help you understand where home prices are at in your community - let me know if you need a referral to someone great in your area. One thing's for sure... If you or someone you know is considering purchasing a home or refinancing, this is an ideal time to see how you can benefit from the current market conditions. Home prices are extremely affordable right now and home loan rates are near historic lows. It only takes a few minutes to look at some options that fit your unique goals and situation. Call or email today to see how you can benefit from the current situation! |

| Forecast for the Week |

|

|

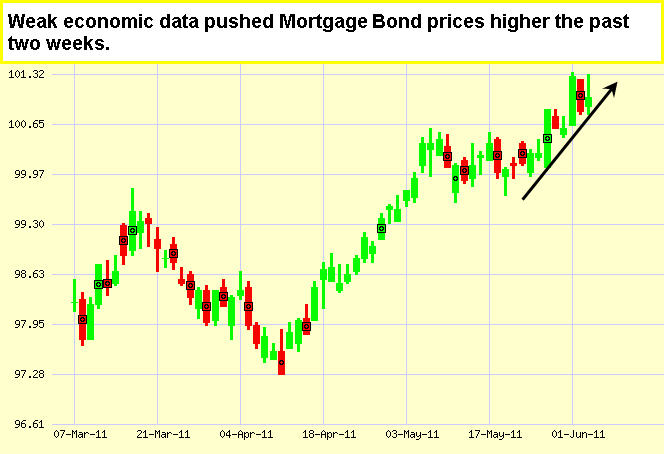

But don't let the slow week of economic reports fool you. With just a few economic reports to digest and the earnings season over, the Bond markets will take their cue from how the Stocks markets move. Soft economic data has put a dent in Stock prices in the past month, so investors may be leery to commit any new funds into the equity markets and could support Bonds. However, the Bond markets will have to contend with $66 Billion in Notes and Bonds to be offered by the Treasury - and the auctions could weigh on Bonds and home loan prices. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Mortgage Bonds and home loan rates have benefited from weak economic data the last couple of weeks. That makes now a great time to purchase a home or refinance. Call or email to see some options that may pleasantly surprise you. Chart: Fannie Mae 4.0% Mortgage Bond (Friday Jun 03, 2011)

|

| The Mortgage Market Guide View... |

|

|

| 10 Great Gifts for College Grads Help them get a head start in the real world. By Cameron Huddleston, Kiplinger.com Some college seniors may be hoping Mom and Dad will spring for an all-expenses-paid trip to Europe so they can go "find themselves" or just take time off before starting the daily grind of 9-to-5 life. Aside from the fact that most parents can't afford this sort of gift, it won't help new grads get a head start in the real world. If you're looking for practical graduation gift ideas, consider these: Interview attire. It's crucial to project the right image if you want to get a job and get ahead. But college seniors are more likely to have closets filled with shorts, jeans and t-shirts than work-appropriate attire. So take your grad shopping for a good suit. For families on a budget, give a nice tie, dress shirt and perhaps some sensible shoes. And share these ten tips with your grad so he or she can ace an interview. Financial advice. If your child knows little about the basics of investing or personal finance, help her learn with a few good books. For easy-to-read primers, see 4 Great Financial Books for Recent Grads. Or get her a subscription to Kiplinger's Personal Finance magazine for just $12. Gym membership. Help your grad release steam after a long day of work at a new job with a gym membership, the price of which tends to drop in spring and summer (so you'll get a deal). Kitchenware. This is a gift people often think of for newlyweds. But college grads can benefit from having pots and pans to cook meals at home and save. Plus, kitchenware tends to go on sale in May, so you should be able to find deals. Grocery gift card. Encourage your grad to cook at home with a gift card to a grocery store. Hopefully, she'll be less tempted to dine out if she can stock her refrigerator for free. You can find discount grocery gift cards at Gift Card Granny. A mattress. Everyone has to sleep. So your college student will surely appreciate a real bed -- rather than that worn-out futon he was sleeping on in his college apartment. And May is a good time to buy mattresses, which can be marked down by as much as 50% as retailers try to make way for newer models. Security deposit for an apartment. For grads just starting out, coming up with the first month's rent and a security deposit can be tough if their first paycheck won't show up until the end of the month. And you don't want them to have to rely on a credit card to make these payments. So consider chipping in by offering to write a check for the security deposit or one month's rent. Renter's insurance. First-time renters often don't realize that they'll have to pay to replace their stuff if it's stolen or damaged by fire or another disaster -- unless they have renter's insurance. You can help them protect their belongings and finances by purchasing them a policy, which usually costs $200 to $300 a year. Help with student-loan payments. Students with loans usually get a six-month grace period before they have to start making payments. If your grad doesn't have a job by that point, he might need help footing the monthly bill because you don't want him to default (see The Dark Side of Student Loans). Consider pitching in until he gets a steady paycheck or can find relief through a loan-deferment program. A head start on retirement savings. If your grad will have earned income from a job, you can open and fund a Roth IRA for her. Even if she has a workplace retirement account, she'll benefit from a Roth because she'll be able to withdraw the money tax-free in retirement. She also can withdraw contributions (not earnings) at any time tax- and penalty-free. To learn more, see The Basics of Roth IRAs. Reprinted with permission. All Contents c2011 The Kiplinger Washington Editors. www.kiplinger.com. Economic Calendar for the Week of June 6-10, 2011 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of June 06 - June 10

|