Sent from my Verizon Wireless BlackBerry

________________________________

From: MMGW

Date: Sun, 8 Aug 2010 09:38:40 -0700

To: Phil Jensen

Subject: MMG Weekly: Economy 'Laboring' Towards Recovery

If you can't see the newsletter, or would like to view it online, use this link If you have received this newsletter indirectly and would like to be added to our weekly distribution list, use this link

[

http://www.mmgweekly.com/admin/images/mmg_logo.gif]

[

http://www.mmgweekly.com/templates/images/weekly/banner_weekly_Blue.jpg]

[

http://www.mmgweekly.com/member/32989/images/jensen-amerifirst.gif-final.gif]

Provided to you Exclusively by Phil Jensen

Phil Jensen

Senior Mortgage Consultant

Amerifirst Financial

Office: 480-682-6613

Cell: 602-692-7445

Fax: 480-374-6987

E-Mail:

Phil@JensenTeam.com Website:

www.PhilipJensen.com [

http://www.mmgweekly.com/member/32989/images/philip-jensen-photo.gif-finallll...]

For the week of Aug 09, 2010 --- Vol. 8, Issue 32

In This Issue

Last Week in Review: The important Jobs Report numbers are in... survey says? Get all the details below.

Forecast for the Week: More inflation news is ahead, plus the Fed is meeting. Will they shake up the markets?

View: Web cam interviews are growing in popularity these days. Learn tips for acing one!

Last Week in Review

WORKIN' NINE TO FIVE... WHAT A WAY TO MAKE A LIVIN'..." Dolly Parton. But unfortunately, last week's Jobs Report was worse than expected, showing more and more people aren't workin' nine to five or any other kind of full time job. So what does this mean for our economy and home loan rates? Read on to find out.

[

http://www.mmgweekly.com/templates/mmgweekly/spe_chart/Top_Chart_8_9_10.jpg]Last Friday's Jobs Report showed that 131,000 jobs were lost for the private and government sectors, versus the 87,000 job losses expected. To add insult to injury, the revisions for June showed nearly 100,000 more jobs lost than had been previously reported. While some of the losses were due to the government laying off temporary census workers, the private sector was also disappointing, showing 71,000 job creations for July, worse than expectations of 83,000... and well short of the market's hope of 100,000. Rounding out the report, the Unemployment Rate remained steady at 9.5%, just below the 9.6% anticipated.

In addition, something to keep in mind is that the State governments are now under major pressure because of growing budget deficits. With tax revenues declining and budget cuts needed, States are finally having to make cuts like the private sector already has. As they start to catch up in making cut-backs to headcount, this could cause the unemployment rate to worsen. Not very good news, as an improvement in the labor market is needed to fuel the economic recovery... and especially disappointing, considering the money that has been injected to try and remedy this situation.

Also in the news, the Commerce Department reported last week that Personal Spending and Incomes were unchanged in June, due to a slowing of the economic recovery in the spring. In addition, the Savings Rate increased as consumers cut back on spending.

Why is all this significant... and what does it have to do with interest rates? It has to do with something called the velocity of money. Even though the government keeps pumping money into the system, nothing happens until that money is spent or lent, and passes from one hand to another, or one business to another. The speed at which this money passes between parties is called the velocity of money. With the job market still very sluggish, consumers aren't spending much money these days... and businesses are still reluctant to spend money making investments in their business. With present velocity at low levels, inflation remains subdued... however, once velocity increases, the excess money in the system will cause inflation.

And remember, inflation is the arch enemy of Bonds and home loan rates... which means that even the scent of inflation can cause home loan rates to worsen.

While we certainly want to see better Jobs Report numbers in the future, Bonds and home loan rates were able to benefit from the poor report. Remember, weak economic news often causes money to flow from Stocks to Bonds as traders seek to protect their investments in the safer haven of Bonds. As a result, Bonds and home loan rates ended the week slightly better than where they began.

If you or anyone you know would like to learn more about taking advantage of historically low home loan rates, please don't hesitate to call or email. Or forward this newsletter on to anyone you think may benefit and I'd be happy to talk to them free of charge.

ACING A JOB INTERVIEW IS ESPECIALLY IMPORTANT IN TODAY’S TOUGH JOB MARKET. CHECK OUT THE MORTGAGE MARKET GUIDE VIEW FOR SOME TIPS ON HAVING A GREAT WEB CAM INTERVIEW.

Forecast for the Week

There will be plenty of action ahead this week, beginning with Tuesday's Federal Open Market Committee meeting. This week's meeting will be very important and closely watched as the important "extended period" language will come under scrutiny, as well as options that the Fed will discuss to further stimulate the economy and avoid deflation. Their decisions could certainly impact home loan rates, and I will be watching closely to see what happens.

Also this week, Thursday brings another Initial and Continuing Jobless Claims Report, while on Friday we will see both the Retail Sales and Consumer Price Index (CPI) Reports. Remember, last week it was reported that Personal Savings increased, so it will be important to see how this impacts Retail Sales. And, as mentioned above, any hint of inflation can hurt Bonds and home loan rates, which is why the CPI Report - which measures inflation at the consumer level - is also an important one to watch.

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result.

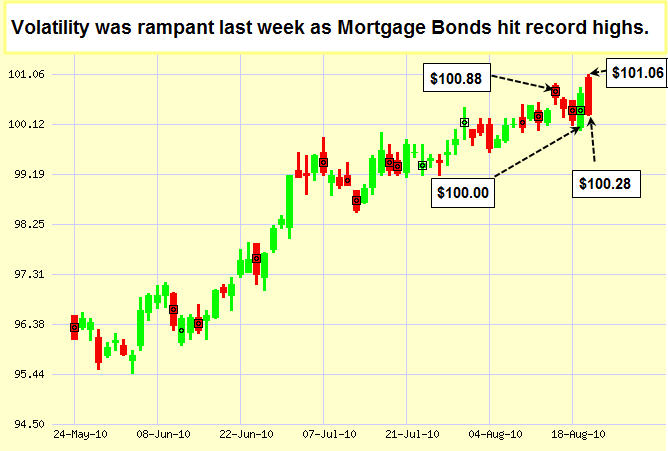

As you can see in the chart below, Bonds and home loan rates continue to improve, most recently aided by the weak Jobs Report.

-----------------------

Chart: Fannie Mae 4.0% Mortgage Bond (Friday, August 6, 2010)

[

http://www.mmgweekly.com/templates/mmgweekly/reg_chart/258/images/Weekly_Char...]

The Mortgage Market Guide View...

How to Succeed on Webcam Interviews

Webcams have steadily grown in popularity in households across the country. Now, companies are embracing the technology as a cost-effective, timesaving way to conduct interviews. And businesses aren’t the only ones turning to this technology. Colleges and universities - such as the University of Georgia, Pennsylvania State University, Arizona State University, and Wake Forest - are also using the technology to interview applicants before admitting them.

If you or someone you know is in the process of applying for a new job or to a university, the following information can help you put your best foot forward if you’re asked to participate in a webcam interview.

Eliminate distractions. When you’re on a webcam at your house, you can be interrupted by the phone ringing, the kids playing, or the doorbell ringing. To make sure that doesn’t happen, find a quiet place where you can avoid any distractions that may compromise your interview.

Remove the clutter. A webcam interview doesn’t just allow the company to see you; they can also see into your home. If the background setting looks messy, cluttered, or less than professional, it may taint the company’s perception of you. So, clean up everything that will be in the background, including those things that are off in the distance. The best advice is to have a clean, simple background setting for the interview where only one or two major pieces of furniture can be seen.

Dress for success from top to toe. While it may be tempting to dress professionally from the waist up while wearing shorts or pajamas below, don’t do it. There are too many stories of people who found themselves reaching for a book or retrieving an object during the interview, only to be embarrassed by the lack of professional attire on their legs. And while the situation may sound laughable, the company interviewing you may take it as a sign that you’re either trying to get away with something or that you’re the type of person who does things halfway.

Check the lighting. Anyone who’s ever used a webcam realizes that you can sometimes appear pale or tired in an online video. To overcome this problem, you can take a few simple steps. First, make sure you are well rested before the interview. Second, check the lighting. You’ll want the room to be bright, but not so bright that your face is washed out. If you need additional lighting, bring a lamp or two into the room.

Maintain eye contact. To make sure you maintain eye contact, look directly at your webcam - rather than at the person’s image on your monitor. It may feel awkward at first, but it will appear natural and professional to the person on the other end.

Test your equipment. No matter how familiar you are with a webcam, you should arrive at your desk well before the interview and test your equipment. You may even want to consider video chatting with a friend for a few minutes.

Send the right body language. Like a face-to-face interview, your posture and body language are important online. So sit up straight, use simple hand gestures as you talk, and resist the urge to fidget or make a lot of unnecessary movements (like scratching your head or constantly readjusting your seating position).

Be specific, yet concise. Provide concise answers that convey specific details. Prepare specific talking points and details about your accomplishments, and then practice saying them succinctly. But don’t memorize a script like you would a speech. Instead, focus on working some talking points into different types of answers.

Finally, don’t be put off by a short silence after you finish speaking, which is likely due to the time delay. Remain confident and stick to your concise statements.

--------------------------

Economic Calendar for the Week of August 9-13, 2010

Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise.

Economic Calendar for the Week of August 09 - August 13

Date

ET

Economic Report

For

Estimate

Actual

Prior

Impact

Tue. August 10

08:30

Productivity

Q2

0.1%

2.8%

Moderate

Tue. August 10

02:15

FOMC Meeting

8/10

0.25%

0.25%

HIGH

Wed. August 11

08:30

Balance of Trade

Jun

-$42.5B

-$42.3B

Moderate

Thu. August 12

08:30

Jobless Claims (Initial)

8/07

465K

479K

Moderate

Fri. August 13

08:30

Consumer Price Index (CPI)

Jul

0.2%

-0.1%

HIGH

Fri. August 13

08:30

Core Consumer Price Index (CPI)

Jul

0.1%

0.2%

HIGH

Fri. August 13

08:30

Retail Sales

Jul

0.5%

-0.5%

HIGH

Fri. August 13

08:30

Retail Sales ex-auto

Jul

0.2%

-0.1%

HIGH

Fri. August 13

10:00

Consumer Sentiment Index (UoM)

Aug

70.0

67.8

Moderate

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is not without errors.

As your trusted advisor, I am sending you the MMG WEEKLY because I am committed to keeping you updated on the economic events that impact interest rates and how they may affect you.

In the unlikely event that you no longer wish to receive these valuable market updates, please USE THIS LINK or email:

Phil@JensenTeam.com If you prefer to send your removal request by mail the address is:

Philip Jensen

1910 S. Stapley Dr., Ste.209

Mesa, AZ 85204

Mortgage Success Source, LLC is the copyright owner or licensee of the content and/or information in this email, unless otherwise indicated. Mortgage Success Source, LLC does not grant to you a license to any content, features or materials in this email. You may not distribute, download, or save a copy of any of the content or screens except as otherwise provided in our Terms and Conditions of Membership, for any purpose.

[

http://www.mmgweekly.com/templates/spare_images/ehllogo_btm.gif]

________________________________

NOTE: THIS IS A CONFIDENTIAL AND PRIVILEGED COMMUNICATION. This transmission is intended only for use by the individuals or entities to which it is addressed, and contains confidential and/or privileged information. If the reader of this message is not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are hereby notified that any dissemination, distribution or copying of this communication is strictly prohibited. If you have received this communication in error, please send a reply to us and permanently delete the e-mail from your computer.

Posted via email from philipjensen's posterous