| |

|

| |

| | In This Issue  |

| | | | | | Last Week in Review: Good news at home and abroad impacted the markets and home loan rates last week. Find out how. Forecast for the Week: Earnings season is in full swing, plus look for big news on manufacturing, housing, and inflation. View: Wondering about the outlook for the housing and mortgage markets in 2012? Be sure to read the article below. | | | | | |

| | Last Week in Review  |

|

|

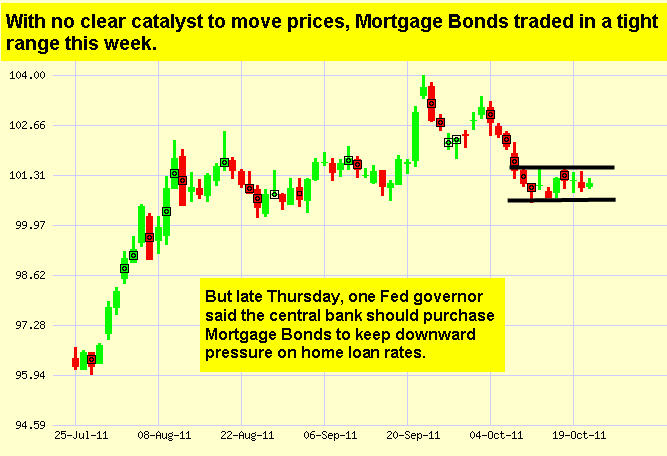

| | | | | | “It’s a small world after all.” And that proved especially true last week, as our markets were impacted by news at home and news from overseas. Here are the highlights.  First, there was some good news on the economic front in the U.S. as Retail Sales for September rose by 1.1%, above the 0.6% expected and the highest increase in seven months. Remember good economic news typically benefits Stocks at the expense of Bonds (including Mortgage Bonds, to which home loan rates are tied), as investors move their money from the safety of Bonds into Stocks to try and take advantage of gains. First, there was some good news on the economic front in the U.S. as Retail Sales for September rose by 1.1%, above the 0.6% expected and the highest increase in seven months. Remember good economic news typically benefits Stocks at the expense of Bonds (including Mortgage Bonds, to which home loan rates are tied), as investors move their money from the safety of Bonds into Stocks to try and take advantage of gains. And good news here wasn’t the only thing that pressured Bonds and home loan rates last week. The European Central Bank (ECB) said they will announce a plan by early November for addressing the Greek debt crisis and make recapitalizing their banks a priority. As part of this plan, the International Monetary Fund is going to dedicate more resources to help the European debt crisis. A lot of money is needed to make investors feel confident that the debt crisis will be contained, so investors saw this as positive news. So what does this mean for Bonds and home loan rates? Should the overall present optimistic tone continue, Bonds and home loan rates could face additional pressure. However, if there is pessimistic or uncertain news, investors may return to the safe haven of Bonds, meaning home loan rates could benefit. We did see a little of this trend last week when there was word that China's exports came in lower than expectations, which brought concern that global growth could continue to slow.

Either way, the volatility is sure to continue so the most important thing to remember is that now is still a great time to purchase or refinance a home, as home loan rates remain near historic lows. Let me know if I can answer any questions at all for you or your clients.

| | | | | |

| | Forecast for the Week  |

|

|

| | | | | | Manufacturing, inflation, and housing reports dominate the news this week: - The manufacturing sector accounts for one-quarter of the economy, so it’s especially important during the current economic situation. This week, the New York State Empire Manufacturing Index as well as Industrial Production and Capacity Utilization will be released on Monday. Later in the week, the Philadelphia Fed Index will be reported on Thursday.

- Inflation news from the Producer Price Index (PPI) and the Consumer Price Index (CPI) will be delivered on Tuesday and Wednesday respectively. The last report on consumer inflation was a bit hotter than expected, so Bond market players will be closely watching those reports.

- Housing Starts will be reported on Wednesday and on Thursday Existing Home Sales will be delivered.

- The weekly Initial Jobless Claims report will be released on Thursday. As of last week’s report, they continue to remain above the 400,000 level.

Plus, earnings season is in full swing this week. Some big names reporting earnings are Citigroup, Bank of America, Coca-Cola, Apple, and AT&T. If the reports come in better than expected, it could push investing dollars over to the Equity markets. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds and home loan rates faced pressure last week but remained above a key technical level. I’ll be watching the markets closely this week to see what happens. Chart: Fannie Mae 3.5% Mortgage Bond (Friday Oct 14, 2011) | | | | | |

| | The Mortgage Market Guide View...  |

|

|

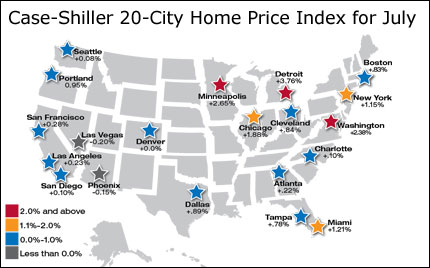

| | | | | | | | | | | | | | The Housing and Mortgage Markets in 2012 Last week, the Mortgage Bankers Association (MBA) released its outlook for the housing and mortgage markets in 2012. Overall, the news is mixed, but there’s some good news to glean out of it. Here are three positive elements in the MBA forecast that you should know about: 1. Home Sales Steady Before Slight Increase The MBA expects total existing home sales will stay around the 4.9 million unit pace for 2011 and 2012. But in 2013, the MBA expects home sales to increase slightly to 5.2 million units, as the broader economy recovers. New home sales are expected to be similar to the overall trend. As the MBA stated in its release: “The recovery in the new home sales will have a comparably slow start…but will show some meaningful increases in 2013.” 2. Slight Growth in Home Purchases Despite an expected decrease in refinances, the MBA forecasts some slight growth in the number of mortgages for home purchases. Specifically, the MBA anticipates home loans for purchases to increase to $412 Billion in 2012, which would be up from the anticipated 2011 total of $400 Billion. Better still, the MBA expects home loans for purchases to jump significantly to $700 Billion in 2013 as the economy, home sales, and home prices are all anticipated to pick up. 3. Rates to Remain Low Overall, fixed home loan rates are expected to remain low by historical standards. The MBA expects rates to end 2011 around a 4.5 percent average, and then possibly dropping slightly to 4.4 percent at some point in 2012. But by 2013, the MBA expects rates to climb back up to 4.9 percent – w | |

Posted via email from philipjensen's posterous

In order to really have an impact on housing, the Fed would have to announce something significant to get people to buy a home. Why? Because even now, with rates at historically low levels and incredible affordability levels, the sales pace in housing is tepid, due to structural problems in the labor market, which the Fed can't fix.

In order to really have an impact on housing, the Fed would have to announce something significant to get people to buy a home. Why? Because even now, with rates at historically low levels and incredible affordability levels, the sales pace in housing is tepid, due to structural problems in the labor market, which the Fed can't fix.