|

|

| |||||||||||||

| ||||||||||||||

| For the week of Aug 23, 2010 --- Vol. 8, Issue 34 |

| In This Issue |

|

|

| Last Week in Review: Change is needed in the housing and job markets. Find out what kind... and how will those steps impact home loan rates? Forecast for the Week: We’ll get reads on the housing market and the economy this week, but what direction will the reports show? View: It may take two credit reports to make a closing go right. Find out why in this week’s View. |

| Last Week in Review |

|

|

| "There is nothing wrong with change, if it is in the right direction." Winston Churchill. And certainly, seeing our economy improve is change in the right direction. But what steps will get us there... and how will those steps impact home loan rates. Here’s what you need to know. Last Tuesday, the government held a "Future of Housing Finance" conference to discuss changes needed in this area. Most participants agreed that government assistance for housing must be reduced but not eliminated. Bill Gross, from PIMCO and one of the panelists, called for a massive refinancing of certain mortgages backed by Fannie/Freddie/FHA, believing such a move would lift home prices 5% to 10% and provide a $50 Billion stimulus to the economy. I will be watching this situation closely for further developments. Home sales and the job market - two key aspects to our continued recovery - are also areas we need to see change in an improving direction. Last week, the NAHB Housing Market Index came in a bit worse than expectations and showed housing to be at a 17-month low. It can be argued that the tax credits actually hurt the housing market by not adding any sales, just pushing them up. This has now resulted in a void or softer period in the market, potentially wasting billions of dollars. Housing Starts and Building Permits were also reported lower than expected last week. Clearly, demand for housing has slowed over the past few months, due to the expiration of the Home Buyer Tax Credit and persistently high unemployment. Speaking of unemployment, awful is the only way to describe last week’s Initial Jobless Claims report. According to the report, 500,000 people filed to receive unemployment benefits for the first time, which was well higher than the lofty 475,000 expected and the highest reading since November 2009. In addition, between Continuing Claims and people receiving Emergency Unemployment Compensation or EUC, the combined total of people receiving unemployment benefits now equals 9.25 Million people. The bottom line is this: The labor market is the foundation of our economy. Job growth and confidence is the best and most sustainable way for our economy to recover. The present anti-business regulatory environment is pushing Initial Claims, a leading indicator on the health of the labor market, in the wrong direction. But home loan rates, meanwhile, continue to remain at historic low levels. Though keep in mind, inflation is the arch enemy of Bonds and home loan rates, which means it can cause both to worsen. Both the Producer Price Index (which measures inflation at the wholesale level) and the Consumer Price Index were recently reported hotter than expected. If rates do start to rise, they will likely do so quickly. If you or anyone you know would like to learn more about taking advantage of historically low home loan rates, please don’t hesitate to call or email. Or forward this newsletter on to anyone you think may benefit and I’d be happy to talk to them free of charge. WHEN YOU’RE BUYING A HOUSE, THE LAST THING YOU WANT IS AN UNSUCCESSFUL CLOSING. CHECK OUT THE MORTGAGE MARKET GUIDE VIEW FOR SOME INFORMATION THAT WILL HELP ENSURE YOUR HOMEBUYING EXPERIENCE MOVES IN THE RIGHT DIRECTION. |

| Forecast for the Week |

|

|

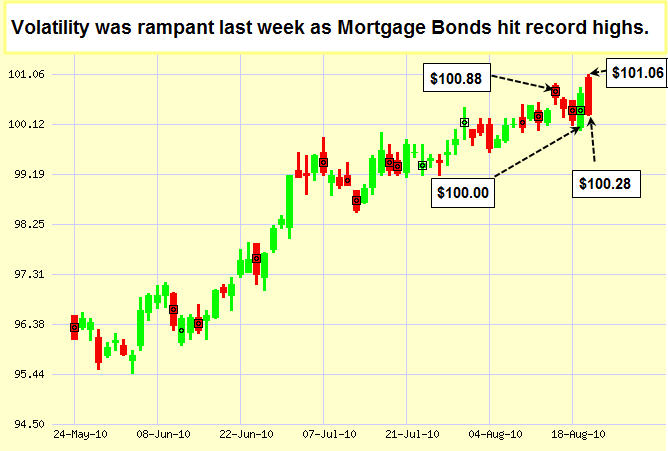

| Also, on Wednesday we'll get a read on the health of the economy with the Durable Goods Report, which gives us an update on consumer and business buying behavior on big-ticket items that last for an extended period of time. Meanwhile, Friday will bring another read on the economy with the Gross Domestic Product Report, which is the broadest measure of economic activity. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, last week’s weak economic news helped home loan rates hit record lows again, but volatility was rampant. I’ll be watching closely to see what this week brings.

Chart: Fannie Mae 3.5% Mortgage Bond (Friday, August 20, 2010)

|

| The Mortgage Market Guide View... |

|

|

| Credit Reports: One May Not Be Enough This summer, Fannie Mae instructed lenders that they should adopt a new policy that would include a second review of an applicant's credit report just prior to closing. Why? The answer is simple: the credit profile of a borrower may have changed between the time of the initial review of the credit report and the time of closing. How will this impact the home loan? The potential impact to a borrower who has utilized credit to make significant purchases after the initial credit report could include:

That’s right, in the worst-case scenario, a change in credit could even result in a loan being denied - even after an original approval had been granted. What should homebuyers do (or not do)? In order to eliminate any possibility of potential problems before closing, anyone in the application process should use credit sparingly and make sure they adhere to the tips provided below by credit expert Linda Ferrari of Credit Resource Corp:

This list is not comprehensive, but it does give you a peek into situations that could create issues and could also be contrary to some ideas you have read previously. -------------------------- Economic Calendar for the Week of August 23-27, 2010 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of August 23 - August 27

|

No comments:

Post a Comment