| ||||||||||||||

| For the week of Jul 26, 2010 --- Vol. 8, Issue 30 |

| In This Issue |

|

|

| Last Week in Review: The Fed and "uncertainty" dominated the news last week... what was all the buzz about? Forecast for the Week: What should you be on the look out for this coming week? View: 10 things you overpay for... and how you can start saving today! |

| Last Week in Review |

|

|

| "UNCERTAINTY AND MYSTERY ARE THE ENERGIES OF LIFE." And while the Bond market may agree with R.I. Fitzhenry's words about uncertainty, most investors in the Stock market don't... just ask Fed Chairman Ben Bernanke. Last week, Mr. Bernanke testified before the Senate and House Banking Committees, making several cautious comments on the state of the labor market and inflation, as well as stating that the Fed would be ready to take action should economic conditions worsen. But the comment that spooked Stocks and helped Bonds was when Mr. Bernanke said the economic outlook is "unusually uncertain." Stocks hate uncertainty but Bonds usually perform well as a safe haven, so Bonds and home loan rates improved upon the utterance of these words. Mr. Bernanke also stated that one way to normalize the size and composition of the Federal Reserve's securities portfolio would be to sell some holdings of agency debt and Mortgage Backed Securities. And an article in the New York Times concurred, stating that the Fed’s MBS holdings are already problematic and put the Fed in a tough position where it may find itself having a conflict of interest - and here’s why. While inflation is subdued for now, it’s only a matter of time before the Fed will need to hikes rates in order to keep inflation controlled. But any hike in rates would cause the Fed to lose significant value on their Mortgage Backed Security holdings. So the tough question is... how will the Fed act, in light of this conflict? Remember, the Fed purchased $1.25 Trillion worth of Mortgage Bonds, as well as several hundred Billion in Treasuries. Those purchases helped drive rates down towards historic low levels - and yet the housing market is still not entirely healthy. So this also begs the question, what would cause a different result? One perspective is that the Fed - like many in Washington - missed the point. The problem is not that rates need to be lower. Many individuals already want to purchase or refinance at today’s low rates, but are unable to do so because of tighter underwriting guidelines, as well as low valuations. A perfect example is the "no income verification" loan - which has been cast in a negative spotlight as a "liar loan" and virtually eliminated. But there has been a good track record for those loans in the past when underwritten properly. If the government were to direct some resources towards reestablishing some of these more reasonable lending tools, the results m ight be better. Instead - the sweeping Financial Reform Bill was signed into law last week, and the implications of this 2,300-page legislation are sure to be broad. Former Fed Chairman Alan Greenspan himself said that every page appeared to be loaded with unintended consequences... so as this legislation is analyzed and dissected, you can be assured I’ll be keeping a close eye on the impacts it may have and will keep you informed. ----------------------- Fed Chair Bernanke Calls the Outlook "Unusually Uncertain"

But the Federal Reserve and Financial Reform are only part of the picture. Mortgage Bonds and home loan rates are also impacted by global financial news. In fact, just last week the Bank of Canada raised rates by .25%, up to .75%... and this could have a major implication on our Bonds. Part of the reason home loan rates have dropped so much has been the currency trade, where the Euro has weakened against the Dollar. Europeans have been taking advantage of the currency trade, and parking money in the US - much of which is in our Bonds. But now, with Canada’s improving economy and slightly higher rate environment, their yields might not only be more attractive for Europeans, but their currency may provide a more lucrative option as well. And the sell-off in our Bonds early last week could have been somewhat due to traders anticipating this move by the Bank of Canada. Another story of uncertainty is developing in China. China's reserves, which are held mostly in US Treasuries as well as Mortgage Backed Securities, stand at $2.5 Trillion. But last quarter marked the first time in a long time that these holdings did not increase. Does this mean that China is slowing their US debt purchases? I will be keeping close tabs on this because a slowdown in US debt purchases from China could adversely impact the Bond market, as their purchases have also contributed to the low rate environment in the US. THESE BIG-PICTURE DEVELOPMENTS IMPACT THE MARKETS AND, IN TURN, YOUR FINANCIAL SITUATION. BUT EVERYDAY PURCHASES CAN ALSO DRAIN YOUR HOUSEHOLD BUDGET. CHECK OUT THE MORTGAGE MARKET GUIDE VIEW BELOW TO LEARN HOW YOU CAN STOP OVERPAYING... STARTING RIGHT NOW. |

| Forecast for the Week |

|

|

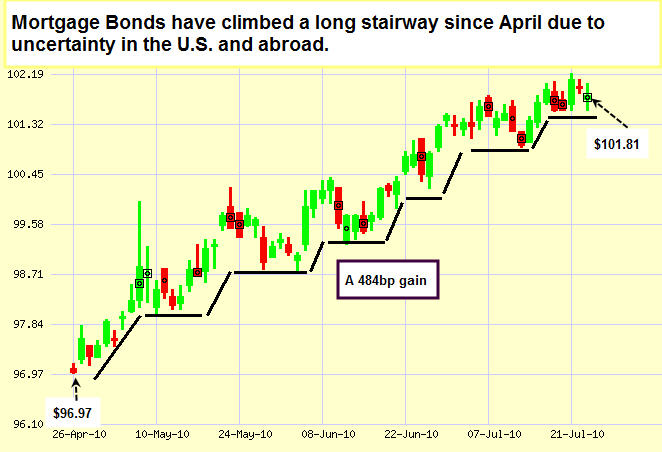

| The manufacturing sector of the economy will also be in the spotlight this week. On Wednesday, Durable Goods Orders will be released. Then Friday brings the Chicago PMI, which surveys more than 200 Chicago purchasing managers about the manufacturing industry and is a good indicator of overall economic activity. On Thursday, we’ll see another weekly read on Initial Jobless Claims. Last week, Initial Jobless Claims rose by 37,000 to 464,000, which was above the 445,000 that was expected. Overall, unemployment is still disappointingly high. The news heats up on Friday when we get a look at the Gross Domestic Product (GDP) and GDP Chain Deflator for the second quarter. The Chain Deflator is a key inflation measure included in the GDP Report. And since inflation is the archenemy of Bonds and home loan rates, this report could be a market mover. Finally, there are two reports on tap this week regarding how consumers feel about the economy with the Consumer Confidence report on Tuesday and the Consumer Sentiment Index on Friday. In addition, the Treasury Department will auction $38 Billion in 2-Year Notes on Tuesday, $37 Billion in 5-Year Notes on Wednesday, and $29 Billion in 7-Year Notes on Thursday. Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As stated above, uncertainty in the US and abroad has been impacting the markets, which has helped Mortgage Bond prices climb steadily higher since April, as you can see in the chart below. And this means that home loan rates have moved steadily lower. This presents an unbelievable opportunity for people looking to purchase or refinance a home. It only takes a few minutes to see how you or someone you know can benefit from today’s low rates. Even if you’re not sure you can refinance, it doesn’t hurt to conduct a quick review. Please call me today before this opportunity passes by. ----------------------- Chart: Fannie Mae 4.0% Mortgage Bond (Friday, July 23, 2010)

|

| The Mortgage Market Guide View... |

|

|

| 10 Things We Overpay For: You Can Save Big by Buying Cheap Alternatives Instead By Joan Goldwasser, Kiplinger.com Does the avalanche of news about layoffs, business losses and a declining stock market have you looking for ways to cut your spending so you can beef up your savings? We're here to help, with suggestions for less-expensive alternatives to ten everyday purchases (for more ideas, go to www.BillShrink.com, which tracks cell-phone plans and credit cards). Afternoon snacks. Do you munch protein bars as a healthier alternative to a chocolate pick-me-up? You could easily be paying more than $2 per bar and consuming just as much sugar as you would with your favorite candy bar. Stock up on fruit for a fraction of the cost when you do your grocery shopping. You'll be fitter and save a bundle. Bottled water. Yes, it's important to drink water every day. But picking up the bottled variety with your lunch is an expensive way to stay hydrated. Rather than spend $2 a day for water, buy a pitcher and a filter for about $20 and drink as much as you want for pennies a glass. A caffeine fix. Can't get through the day without at least one cuppa Joe? Stopping at Starbucks or Dunkin' Donuts can set you back as much as $1.65 per cup. Splurge on a pound of gourmet coffee for $8 to $13 and you can make 40 cups for about 20 cents to 33 cents each. Favorite tunes. Do you rush out to buy the latest CD by your favorite group even though there are only one or two songs you really like? Instead of paying up to $18 for the CD, download those cuts you want from iTunes for 99 cents each, or from Amazon for as little as 79 cents. A night at the movies. An evening for two at your local theater costs an average of about $20, including the popcorn - and closer to $30 in major cities. And that doesn't even count the babysitter. For just $5 a month, you can watch two movies from Netflix or pay $9 for unlimited viewing. If you're willing to wait a little longer for new releases, borrow them free from your local library. (See Cut the Cable Cord for other inexpensive entertainment options.) Fresh flowers. A bouquet of spring blooms brightens up a room and your mood. But purchasing it from a florist at $25 and up can quickly put a dent in your budget. Check out your local grocery store, which offers a selection of seasonal bouquets for $5 to $10. Fruits and veggies. Sure, precut vegetables and salad mixes that are washed and bagged save a little time. But you'll pay for the convenience. Broccoli florets and sliced peppers cost $6 per pound, compared with one-third to one-half the price for the uncut versions. Lettuce varieties that are pre-washed and bagged sell for $5.98 a pound. But it takes just minutes to wash and spin dry enough arugula for your evening salad, and you'll pay one-third as much. Buying whole strawberries rather than sliced ones that are prepackaged cuts the price by 75%. Credit-card fees. Every month, millions of credit-card customers pay their bills late, and they're assessed as much as $39 each time. Set up an automatic debit and you'll never incur another late fee. ATM fees. Each time you use an out-of-network ATM you pay an average of $3.43. Do that once a week and you'll rack up almost $180 in ATM fees every year. Avoid those charges by selecting a bank with a large ATM network or an online account that reimburses your ATM fees - such as the eOne no-fee account from Salem Five Direct bank. Another alternative: Get cash back at the grocery store. Fax and mail services. Instead of paying FedEx $1.49 to fax one page, sign up to send free faxes from a provider such as faxZero or K7.net. Save on shipping with the U.S. Postal Service's priority mail service. You'll pay just $4.95 to mail an envelope or small box anywhere in the U.S., and your parcel is likely to arrive within two days. Larger packages cost $10.35. That saves at least 50% compared with UPS's two-day service, the cost of which varies by weight and distance. Reprinted with permission. All Contents © 2010 The Kiplinger Washington Editors. www.kiplinger.com -------------------------- Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of July 26 - July 30

|

No comments:

Post a Comment