In This Issue... |

|

Last Week in Review: January’s Jobs Report is in - was it a good or bad one? Forecast for the Week: It’s a quiet week when it comes to economic reports, but it remains to be seen whether the news from around the world will be good or bad for our markets. View: Need some cough syrup? Just ran out of bandages? Read this week’s View article...and learn more about the new Flexible Spending Account rules...before you head to the store. |

Last Week in Review |

|

"Bad news goes about in clogs, good news in stockinged feet." Welsh Proverb. And there was certainly both good and bad news in last week’s Jobs Report. Here’s what we saw...and what this means for home loan rates. The Labor Department reported that just 36,000 jobs were created in January, with only 50,000 jobs created in the Private sector, much lower than the numbers anticipated. However, there were upward revisions to both November and December, which added another 40,000 jobs than previously reported. But that’s not the only bit of good news in the report. The Unemployment Rate fell to 9%, down from 9.4% last month, rather than increasing as had been expected. In addition, the U6 or "real" rate of unemployment, which includes discouraged workers and those who have accepted part-time employment for economic reasons, fell to 16.1%, from the previous month of 16.7%...and reflects the lowest level since April 2009! So what does all of this mean when it comes to home loan rates? It’s important to remember two things: First, the Fed’s goals for their current Quantitative Easing policy (dubbed QE2) where $600 Billion is being injected into the economy are to (1) boost Stock prices, (2) create inflation, and (3) lower the unemployment rate. Second, while these goals are designed to stimulate our economy and keep our recovery moving forward, they are also unfriendly to Bonds and home loan rates. In recent weeks, we’ve seen evidence of all three goals: Stocks been improving, the unemployment rate has declined, and we've seen an increase in global unrest of late, not just in Egypt, but in other parts of the world as well... and much of this centers around runaway inflation in commodities and food. This means that the old trading saying, "Don't Fight the Fed" is still ringing true. If the Fed wants to accomplish its three QE2 goals at the expense of Bonds and home loan rates, they probably will. If you have been thinking about purchasing or refinancing a home, this is a great time to get started! Home loan rates are still very attractive, so call or email me if you want to talk about your situation. Or forward this newsletter on to someone you know who may benefit from today’s historically low rates. |

Forecast for the Week |

|

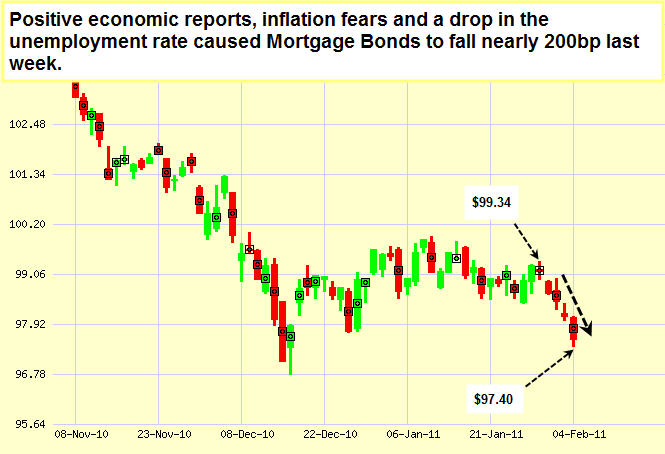

Remember: Weak economic news normally causes money to flow out of Stocks and into Bonds, helping Bonds and home loan rates improve, while strong economic news normally has the opposite result. As you can see in the chart below, Bonds and home loan rates worsened due to a mix of positive economic news, a decline in unemployment, and hints of inflation in the air. I will be watching closely this week to see if Bonds and home loan rates are able to improve at all.

Chart: Fannie Mae 4.0% Mortgage Bond (Friday Feb 04, 2011)

|

The Mortgage Market Guide View... |

|

Make the Most of the New Flex-Account Rules If you have until March to use 2010 FSA money, you can combine it with 2011 funds to pay for big-ticket items. By Kimberly Lankford, Kiplinger.com I know I can no longer use money from my flexible-spending account for over-the-counter drugs without a prescription, but does that mean I’d even need a prescription for things like contact lens solution? I always used FSA money for that. Also, my plan lets me use 2010 money until March 15, 2011. Do the new rules about prescription drugs apply to that money, too? Even though you can no longer spend FSA money for non-prescription drugs, you can still use the tax-free money for many over-the-counter medical supplies without a prescription, such as bandages, contact lens solution, hearing aids, reading glasses, first aid kits and a variety of other purchases, says Jody Dietel of WageWorks, which administers FSAs for employers. For more information about eligible FSA expenses, see WageWorks’ Save Smart Spend Healthy Web site. Even though your employer gives you until March 15, 2011, to use up the money in your account from 2010, you can no longer spend the money on over-the-counter drugs without a prescription after December 31, 2010 (other than the medical supplies mentioned above). You need to submit a prescription along with a receipt (or a receipt listing the Rx number) to your FSA provider in order to get reimbursed for the medication from the account. If you use your FSA money to pay non-qualifying medical expenses, the amount will be included in your gross income and subject to an additional tax of 20%. But there is a loophole in the law: You can still use the money for over-the-counter drugs as long as you have a prescription for them. So the next time you visit your doctor, ask if you can get a prescription for some of the drugs that you use regularly, such as pain relievers, allergy medications, anti-fungal creams, and cough and cold medicines, recommends Dietel. Because you have until March 15, 2011, to use your 2010 money, it’s also a good time to think about another strategy for making the most of your FSA: During this time of year, there’s an FSA sweet spot that gives you an extra-large pot of money to use for major medical expenses. You can still use the money remaining in your FSA from 2010 and you can combine it with the entire amount that you’ve designated for 2011, even though you haven’t actually contributed all of the money from your paychecks yet. This pot of money can be particularly helpful for big-ticket items, such as laser eye surgery and major dental work. To see how much you can save on your taxes by making the most of your flexible-spending account, see our FSA calculator. Reprinted with permission. All Contents ©2011 The Kiplinger Washington Editors. www.kiplinger.com.

Economic Calendar for the Week of February 7-11, 2011 Remember, as a general rule, weaker than expected economic data is good for rates, while positive data causes rates to rise. Economic Calendar for the Week of February 07 - February 11

|

The material contained in this newsletter is provided by a third party to real estate, financial services and other professionals only for their use and the use of their clients. The material provided is for informational and educational purposes only and should not be construed as investment and/or mortgage advice. Although the material is deemed to be accurate and reliable, we do not make any representations as to its accuracy or completeness and as a result, there is no guarantee it is without errors. Philip Jensen

Philip Jensen, Mortgage lender in mesa, chandler, gilbert, tempe, Scottsdale, phoenix Arizona. Offering great mortgage interest rates on first mortgages in the state of Arizona. We have the lowest and best interest rates in the state of arizona

|

No comments:

Post a Comment